Second quarter of 2021 ended just as most COVID restrictions were being lifted and a majority of Oregonians became fully vaccinated. Whether companies have decided to require employees to return to in-person employment, allow for fulltime remote-working, or a hybrid thereof, it is evidenced that business is back to (almost) pre-COVID existence.

In the early days of the pandemic there was a lot of discussion regarding the “new normal”. A few of these new normalcies include DoorDash as a regular dinner option, scheduled weekly Amazon grocery delivery, and curbside pickup as offered by many retailers. These changes in our professional and consumer habits have a direct effect on commercial real estate. Remote working has contributed to companies reducing their office space, home delivery providers has pulled many service industry workers out of restaurants and put them behind the wheel, and the increase of consumer online spending has been a boon to the fulfillment and distribution industries.

Industrial product has done well as plenty of manufacturing operations stayed open and flourished during COVID, retail goods are moving to warehouse space, and logistics providers need space to service transportation demand. The urban growth boundaries in the Portland Metro haven’t changed, so the buildings and land inside the boundaries are at a premium.

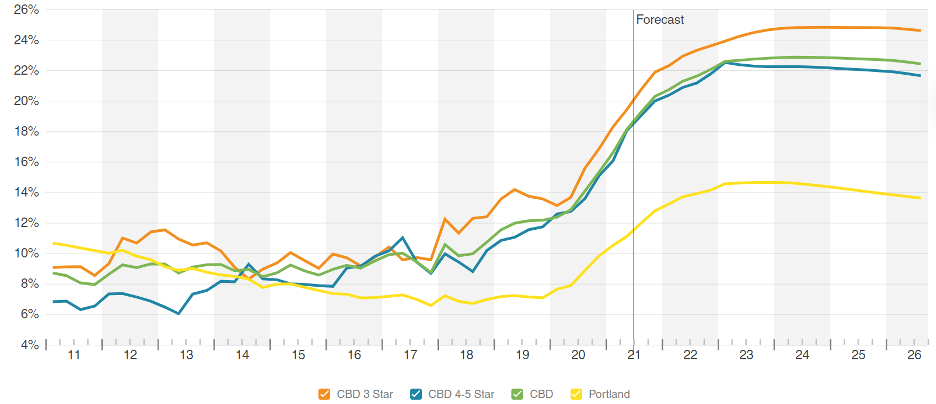

Office has seen a bit of a different turn. For office, the bleakness of downtown activity cannot be understated. At 18.3% vacancy rate for the downtown office market there continues to be a glut of office space with little to no leasing activity to forecast a reasonable absorption period. Suburban office leasing has experienced steady activity and in some cases landlords have raised asking rates. Rents in the Kruse Way area have reached $40/SF over the past month.

Downtown Portland Office Vacancy Rates vs. Portland Metro Region

(Source: CoStar)

Industrial leasing has been strong for properties that have optimal layout and efficiencies. For example, four large close-in industrial buildings totaling nearly 900,000 square feet remain vacant while outlying, efficient warehouse space with additional truck parking is quickly leased.

Developers remain active in pursuit of well-located industrial sites driving industrial land prices to unprecedented levels. Demand is beginning to trickle into secondary markets with less competition and lower prices.

For both property types, landlords have been pulling back on concessions as demand remains strong across the region with the exception of Downtown office leasing. Over the last six months we have seen lease terms on average of three-to-five years. Longer term leases are becoming more prevalent with larger tenant improvement budgets as companies gain confidence in predicting future space needs post-COVID.

The investor market is hyper-competitive with buyers accepting lower yields with quality product selling at prices well over asking. Both buckets have plenty of buyers, but inventory remains low, and as a result, more off-market transactions are being entertained. Cap rates are compressing for new product, especially industrial whose sales remain strong with an upward trend on pricing. Given the limited inventory for owner/user industrial buildings, land is also in strong demand with a sharp uptick in prices over the last 18 months. The demand for small owner/user office buildings on the Westside of Portland continues its healthy appetite although Office inventory remains very low for both investment and owner/user options.

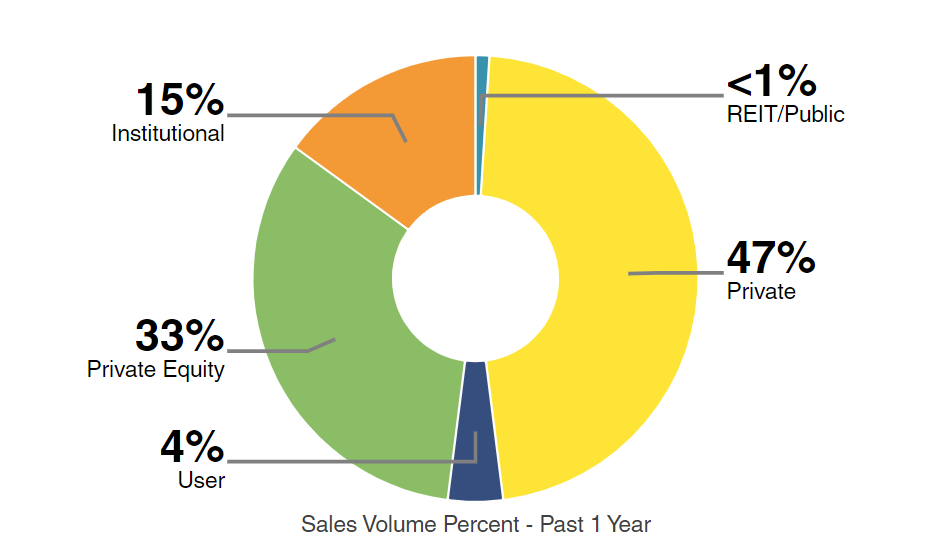

Office Sales by Buyer Type

(Source: CoStar)

Industrial Sales by Buyer Type

(Source: CoStar)

In addition to the changes in professional and consumer habits, we have also discovered we enjoy spending time with our loved ones. Expect to see an increase in the hospitality industry as we take more vacations, and an increase in consumer spending during the holidays as we treasure the time with our friends and family.